A complete guide to modifying and managing taxes in Odoo in 2025

Recent tax changes in Nova Scotia are a reminder of the importance of precise management of tax parameters in Odoo. Companies must regularly adapt their tax configurations to comply with current regulations. This practical guide presents the complete process for modifying and managing taxes in Odoo, applicable to any tax change, whatever your region.

The fundamentals of tax management in Odoo

Odoo Taxation System Architecture

The tax engine of Odoo is based on a three-tier interconnected structure. The PostgreSQL database stores tax data, while the application server manages the business logic of tax calculations. The user interface allows for the visualization and adjustment of tax rules.

This modular architecture facilitates adaptation to changes, such as the recent decrease in HST in Nova Scotia. Each component serves a specific role:

Data Base

Secure storage of tax rates and rules.

Business Layer

Automatic calculations and tax validation.

Interface

Visualization and updates of parameters.

A versioning system allows for scheduling changes in advance, ensuring a smooth transition during tax updates.

Types of taxes supported by the platform

Odoo manages a wide range of tax configurations. Businesses can set up simple taxes like the HST in Nova Scotia, as well as more complex structures with multiple levels of taxation.

The tool supports inclusive taxes directly embedded in prices, compound taxes calculated in a cascading manner, as well as bundled taxes applied simultaneously. This flexibility proves particularly useful during regulatory changes, such as the upcoming reduction of the HST to 14% in Nova Scotia.

The management of tax exemptions, reduced rates, and specific rules by region is carried out intuitively thanks to preconfigured templates tailored to each jurisdiction.

Impact of tax changes on accounting

Changes in tax rates have accounting repercussions that must be anticipated. Invoices issued before the change retain the old rate, even if payment is made afterwards. For Nova Scotia, sales invoiced before April 1ᵉʳ, 2025 remain subject to the 14% rate.

The adjustment of rates also modifies margin calculations and financial reports. Rigorous tracking of dates becomes essential for tax compliance. Companies must verify their tax parameters on deposits and advance invoices.

The new rate applies only to transactions after the change date. This rule ensures an orderly transition and prevents errors in tax reporting.

Initial configuration of tax settings

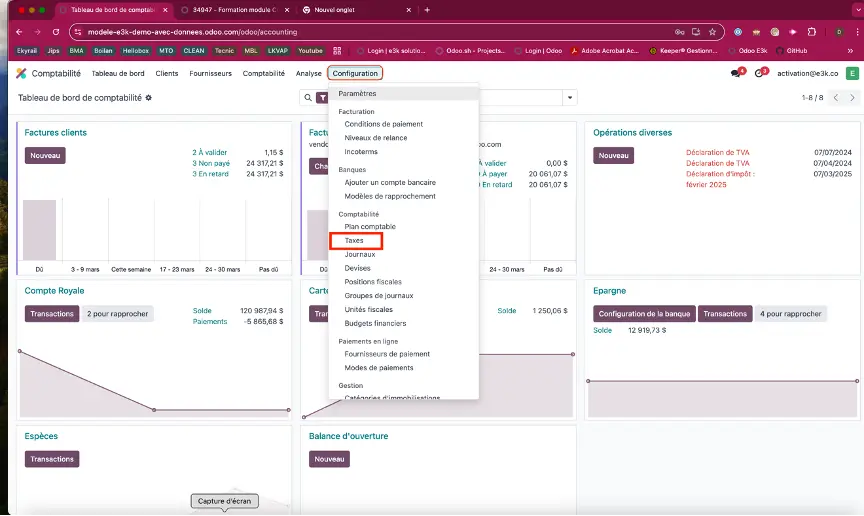

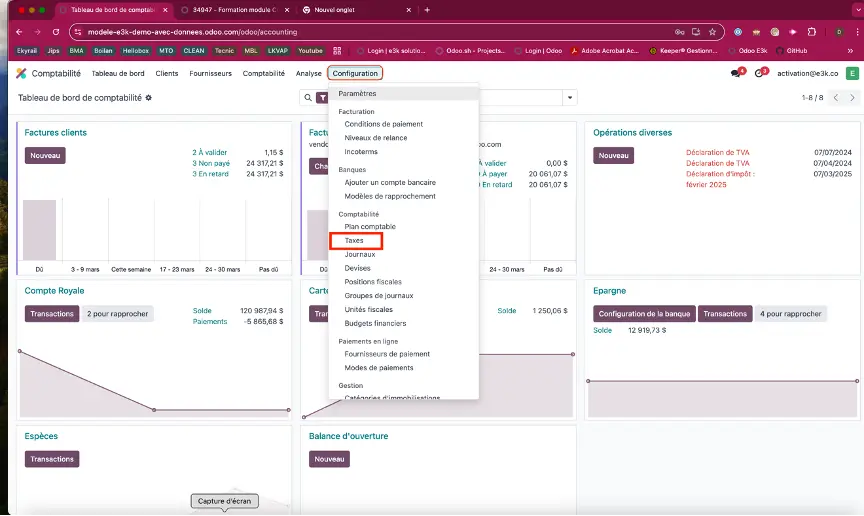

Access to tax settings

Changing the tax settings in e3k.co begins by navigating to the Accounting module. There is a quick shortcut: type "taxes" in the global search bar to directly access the Configuration > Taxes section.

To update an existing tax, such as the HST of Nova Scotia, select the "Active Taxes" tab. The list view displays all configured taxes with their current rates. An intuitive color code distinguishes sales taxes from purchase taxes.

Definition of default taxes

The configuration of default taxes represents a fundamental step in preparing your tax system. A concrete example: when the rate changes to 14% in Nova Scotia, this step allows the new rate to be automatically applied to your future transactions.

Automatic synchronization ensures the uniform application of rates across all your documents. For Nova Scotia, schedule the rate change for April 1, 2025, using the tax change scheduling option.

The systematic verification of parameters is a critical phase before implementing changes. A dedicated dashboard in Odoo allows for quick visualization of the planned modifications, such as the increase to 14% in Nova Scotia.

Validate each item on your configuration screen:

- The exact rate and its date of application

- Associated accounting accounts

- The configured rounding rules

- The impacted tax positions

Process of modifying existing taxes

Method of changing tax rates

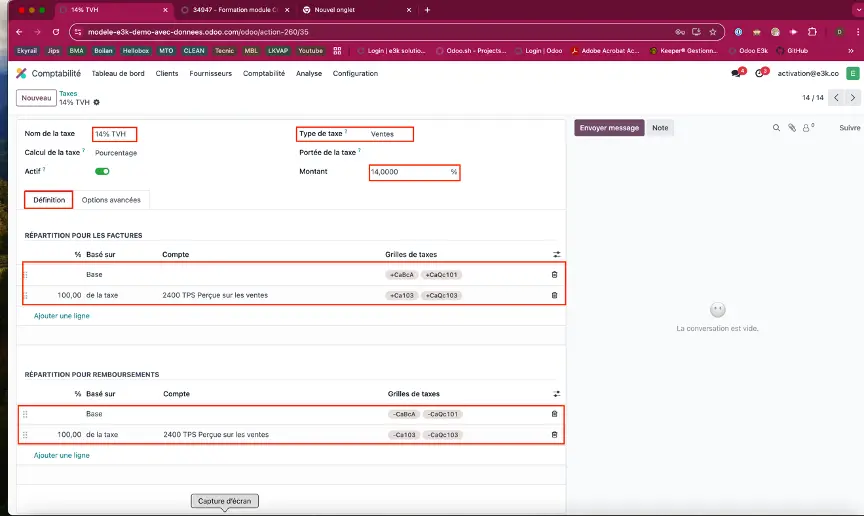

Changing a tax rate in Odoo is done in just a few clicks. Start by selecting the tax you want to modify from your list of active taxes. To adjust the HST rate in Nova Scotia to 14%, go to the "Amount" field in the tax record.

A dropdown menu allows you to choose between a fixed percentage or a variable amount. Enter the new value and specify the effective date of the change. The system automatically provides a preview of the calculation to verify the accuracy of the new rate.

The rate update will apply to all your future transactions from the specified date. For Nova Scotia, schedule the change for April 1, 2025, to comply with the new tax legislation.

Management of the effective dates of changes

The timing of tax changes ensures a smooth transition. In Odoo, navigate to the "Scheduling" tab of your tax to set the exact effective date. For the HST in Nova Scotia, set the switch to April 1st, 2025.

A visual calendar displays all scheduled changes. This overview allows for anticipating transitions and avoiding problematic overlaps. The relevant fiscal periods are highlighted for better readability.

The "Transition Period" option facilitates the management of contracts that span two rates. Activate this feature so that the system automatically applies the correct rate based on the billing date.

Verification of applied changes

Post-change verification requires careful attention to detail. A dedicated dashboard allows you to quickly check any changes applied, such as updating the rate to 14% for Nova Scotia.

Check the verification screen that displays the modified items

- The new rates applied by date

- The affected commercial documents

- Status of current transactions

- The generated system alerts

A quick simulation on a test invoice instantly reveals the correct application of the parameters. Note that the system maintains a complete history of changes to facilitate future audits.

Practical case: Tax update in Nova Scotia

Nova Scotia's HST update provides a perfect example of how to master tax modification in e3k.co. Go to the Accounting module, Configuration > Taxes section. A screenshot will guide you through each step of the process.

Select the existing HST at 15% and create a scheduled version at 14% for April 1st, 2025. The preview function, accessible via the dedicated button, allows you to verify the calculation on a sample transaction.

A practical tip: export the complete list of items affected by this rate change. This will make it easier to track changes and communicate with your teams. The screenshot of the export menu shows you how to proceed.

Best practices for tax management

Securing tax modifications

The protection of tax data is a top priority during rate changes. A dual validation system ensures the reliability of the changes, while a comprehensive audit trail records every modification made to the tax parameters.

Administrators have restricted access based on their responsibilities. This approach, recommended during the HST change in Nova Scotia, minimizes the risk of errors. Sensitive settings remain accessible only to authorized users.

An automatic backup precedes each major change. This preventive measure ensures quick data recovery if needed. The screenshot of the control panel shows the available security options to protect your tax settings.

Testing and validation of changes

The testing phase is a crucial step before the implementation of tax modifications. A simulation environment allows for a faithful reproduction of real usage conditions. You can safely test the transition from a 15% rate to a 14% rate for Nova Scotia.

A series of quality controls checks the consistency of rounding, the accuracy of accounting reports, and the compliance of generated documents. The results appear in a summary dashboard, facilitating the quick identification of any anomalies.

Common Problem Solving

In the event of a VAT calculation error, a quick check of the rounding settings in the Configuration > Accounting menu resolves 80% of cases. A screenshot of the menu guides you to the correct setting.

Tax reporting discrepancies are often caused by incorrectly configured transition dates. For HST in Nova Scotia, accurately set the changeover period to April 1, 2025 in the version parameters.

Practical tips to avoid blockages:

- Check the consistency of the tax groups

- Clear the browser cache after an update

- Use the built-in diagnostic tool

- Synchronize the tax modules with the latest version

A common case: incorrect GST amounts on invoices. The solution can be found in the "Calculation Rules" menu, accessible from the main dashboard.

Frequently Asked Questions

Odoo is compliant with the management of the GST as well as the QST.

Odoo also manages all provincial taxes in Canada and is able to generate periodic remittance reports for each of the provinces where one is registered.

It is also possible to configure specifics such as the management of GST and QST in the accounting of meal expenses.

If by the term "hidden" you mean "to include" taxes in the selling price as is done in Europe with VAT, then yes, it is possible to include taxes in the selling or purchase prices.

In the settings of the Accounting module, it is possible to apply a rounding method.