Details of the tax measure

This temporary exemption concerns the federal tax (GST) and could apply to various holiday essentials, such as certain grocery items and everyday products. However, the provincial tax (QST) remains in effect for these products in Quebec. Understanding this distinction is crucial to the proper management of your sales and purchase invoices.

For further information, please refer to the official documentation published by the government. Otherwise, our consumer taxes explain the impact on entertainment expenses and team meals.

The implications on your tax operations

This measure requires immediate adjustments, if not already made, to your management systems. Specifically, your Odoo configurations will need to be modified to reflect the GST exemption during this period. Without these adjustments, you could :

- Incorrectly applying the GST on your sales invoices;

- Impact the accuracy of your tax reports;

- Risk making mistakes during the tax reconciliation with government authorities (don't worry, if you submit it later, the impact will be nonexistent);

- Risk damaging the relationship with customers. Indeed, it is much easier for you to recover these amounts than for your consumers. Spare them the headaches of filling out forms, update your system.

How to modify Odoo to comply with this measure?

1. Adjust the taxes on products for sale

To remove the GST from the products affected by this temporary measure:

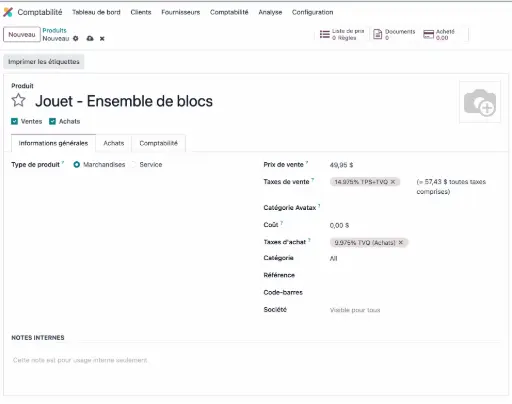

- Access the Accounting or Sales module;

- Go to the Products section and identify the eligible items;

- From the product sheet, access the applied taxes;

- Remove the GST, by selecting only the QST.

2. Modify the purchase invoice settings

For purchased products:

- Still in the Products section, access the purchase settings.

- In the Purchases tab, modify the suppliers' taxes to remove the GST.

3. Use the import-export feature for bulk adjustments

If many products are involved:

- Export a list of eligible products;

- Modify the tax settings in the exported file;

- Reimport the file into Odoo to apply the changes on a large scale.

Do not forget the return to normal

Since this measure is temporary, it will be necessary to restore the tax configurations at the end of the period, that is, after February 15. We recommend that you:

- Keep a copy of the exported files;

- Schedule a reminder or an activity in your Odoo system to reactivate the GST;

- Perform tests on the modified products to ensure proper functioning.

The support from e3k: simplify your adjustments

Our team is ready to help you navigate this transitional period:

- Initial diagnosis: we will assess the impact of the measure on your current setup;

- Update: our experts can adjust your Odoo settings safely and efficiently;

- Follow-up: we will assist you during the reactivation of the taxes.

Know that we have professionals in consumption taxes. If you have any doubts or questions regarding consumption taxes, we can also help you (isn't that wonderful?!).

For more information or to schedule a meeting, contact your project manager or use our contact form. Together, we will ensure the continuity of your operations during this bustling holiday season.

The impact of the GST-QST exemption in Odoo and on corporate taxation